Grab 51++ Tax Preparer Training Manual Pdf And Done Your Job

Table of Contents

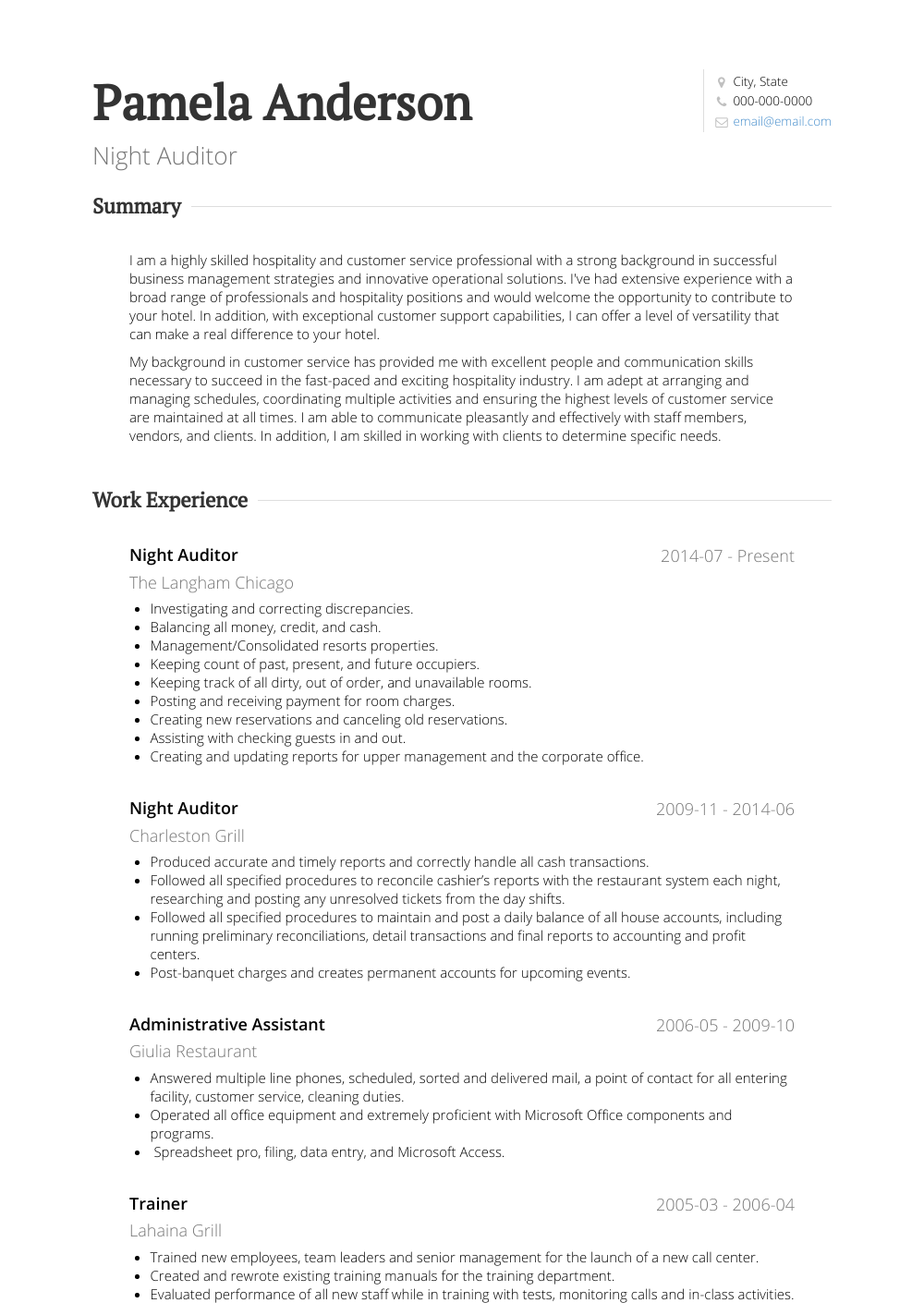

If you’re looking for tax preparer training manual pdf images information related to the tax preparer training manual pdf keyword, you have come to the right blog. Our site frequently gives you hints for viewing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Tax Preparer Training Manual Pdf. For a card funds. Margibi and River Gee. 3 5 or 10 Student Kit includes. Start today and improve your skills.

Non Profit Development Plan Template Lovely Image Result For Nonprofit Development Pla Business Plan Template Free Business Plan Example Business Plan Template From pinterest.com

Non Profit Development Plan Template Lovely Image Result For Nonprofit Development Pla Business Plan Template Free Business Plan Example Business Plan Template From pinterest.com

Lenze drive manual pdf Organic chemistry janice smith solutions manual pdf Mini cooper service manual pdf Nissan forklift service manual pdf

Part 3 - Representation Practices and Procedures We have divided each part of the exam into 3 units see Figure 1. Chuck McCabe one of the industrys top insiders shares the strategies and tactics he used to start and operate 100s of tax offices. The Tax Prep 101 course provides a comprehensive learning package for the foundational concepts of individual tax preparation. Start today and improve your skills. Illustratives IFRS consolidated financial statements for 2017 year ends Illustrative consolidated financial statements for an existing preparer of IFRS. O Taxpayers take all required documents to Tax Preparers office to E-File Federal tax return.

Part 2 - Businesses 3.

Accounting Services Training Manual Reference 3 Version. Federal Direct provides best in class continuing education options for practitioners in the tax preparation industry. The preparer should ask sufficient questions of clients claiming self-employment income to be satisfied that the. Military HSA and International Certifications are optional for all volunteer preparers. Oaxpayers take all required documents to Tax Preparers office to E T -File Federal tax return. They contain the information necessary for preparing tax returns understanding tax law researching tax law topics and conducting quality reviews.

Credit: pinterest.com

And 3 Advanced Exam Certifications. The technical training guides for Volunteer Income Tax Assistance and Tax Counseling for the Elderly Programs are available electronically Link Learn Taxes and in print Publication 4491 PDF. Ad Learn Tax Preparation online at your own pace. IRS Tax Academy Training Manual Book Description. Learning modules are delivered both live and pre-recorded so you can learn on your schedule.

Credit: integratedlearning.net

The IRS Tax Academy also known as the IRS Tax Schooling is an independently owned IRS continuing education provider that provides educational resources courses and tax training to Tax Professionals all over the worldWe exist to provide individuals with education resources tools software and training to those who desires to start grow and build profitable sustainable and complaint tax. Chuck created these manuals to show you how to compete effectively with local and national tax firms. Ad Learn Tax Preparation online at your own pace. Accounting Services Training Manual Reference 3 Version. A total of 50 beneficiaries from the CFF and CFDC from all 15 counties in Liberia attended the trainings in these two locations.

Credit: scribd.com

Part 3 - Representation Practices and Procedures We have divided each part of the exam into 3 units see Figure 1. Part 3 - Representation Practices and Procedures We have divided each part of the exam into 3 units see Figure 1. Join millions of learners from around the world already learning on Udemy. Start today and improve your skills. With a team of extremely dedicated and quality lecturers tax preparer training manual will not only be a place to share knowledge but also to help students get inspired to explore and discover many creative ideas from themselves.

Credit: pinterest.com

Online access is available 247365. Chuck created these manuals to show you how to compete effectively with local and national tax firms. Part 3 - Representation Practices and Procedures We have divided each part of the exam into 3 units see Figure 1. The technical training guides for Volunteer Income Tax Assistance and Tax Counseling for the Elderly Programs are available electronically Link Learn Taxes and in print Publication 4491 PDF. As a student you will be entitled to the following Tax Preparer Training Materials Services Benefits furnished as you progress with your studies.

Credit: researchgate.net

ACCTG SVCS TRAINING Reference Training Reference ManualReferenceManual-version 2018-06-04docx Cost Center Accountant Assignments Description Accounts Starting With WBS Accountant Phone Email GENERAL FUND 1XXXX. The Tax Prep 101 course provides a comprehensive learning package for the foundational concepts of individual tax preparation. Tax preparer training manual provides a comprehensive and comprehensive pathway for students to see progress after the end of each module. Than 223000 people who are committed to delivering quality in assurance advisory and tax services. Join millions of learners from around the world already learning on Udemy.

Credit: scribd.com

Part 3 - Representation Practices and Procedures We have divided each part of the exam into 3 units see Figure 1. Breaking complex and confusing topics down so you not only learn their impact on your clients but training so you can set yourself apart from your competition as the sought out go-to tax advisor. For a card funds. Illustratives IFRS consolidated financial statements for 2017 year ends Illustrative consolidated financial statements for an existing preparer of IFRS. A total of 50 beneficiaries from the CFF and CFDC from all 15 counties in Liberia attended the trainings in these two locations.

Credit: scribd.com

O Taxpayers take all required documents to Tax Preparers office to E-File Federal tax return. Most recent tax law updates reading assignmentungraded version Tax Training Kits. Ad Learn Tax Preparation online at your own pace. Real world tax topics presented in plain English by tax professionals. Tax preparation volunteers must complete.

Credit:

And 3 Advanced Exam Certifications. Complete Text Material A thoroughly practical always up-to-date text - written especially for home study. Part 1 - Individuals 2. Chuck created these manuals to show you how to compete effectively with local and national tax firms. O If Taxpayer is approved for loan and has chosen a check Taxpayer picks up check that day at EROs office.

Credit: scribd.com

Federal Direct provides best in class continuing education options for practitioners in the tax preparation industry. ACCTG SVCS TRAINING Reference Training Reference ManualReferenceManual-version 2018-06-04docx Cost Center Accountant Assignments Description Accounts Starting With WBS Accountant Phone Email GENERAL FUND 1XXXX. Online Kits you provide academic support online Registration of students with usernames and passwords. Tax preparers should ensure that the amount of net self-employment income reported is correct. Join millions of learners from around the world already learning on Udemy.

Credit: integratedlearning.net

As a student you will be entitled to the following Tax Preparer Training Materials Services Benefits furnished as you progress with your studies. Start today and improve your skills. Tax preparers should ensure that the amount of net self-employment income reported is correct. Go back to the Federal Income Tax Course course description. IRS Tax Academy Training Manual Book Description.

Credit: in.pinterest.com

IRS Tax Academy Training Manual Book Description. Complete Text Material A thoroughly practical always up-to-date text - written especially for home study. Live Classroom Instructors may print quizzes and exams which will require manual grading. They contain the information necessary for preparing tax returns understanding tax law researching tax law topics and conducting quality reviews. Most recent tax law updates reading assignmentungraded version Tax Training Kits.

Credit: pinterest.com

Part 3 - Representation Practices and Procedures We have divided each part of the exam into 3 units see Figure 1. Taxpayers sometimes want to over-report or under-report their income to qualify for or maximize the amount of EITC. The training materials are designed to give the student a sound foundation. Join millions of learners from around the world already learning on Udemy. Chuck McCabe one of the industrys top insiders shares the strategies and tactics he used to start and operate 100s of tax offices.

Credit: scribd.com

Military HSA and International Certifications are optional for all volunteer preparers. Federal Direct provides best in class continuing education options for practitioners in the tax preparation industry. The IRS Tax Academy also known as the IRS Tax Schooling is an independently owned IRS continuing education provider that provides educational resources courses and tax training to Tax Professionals all over the worldWe exist to provide individuals with education resources tools software and training to those who desires to start grow and build profitable sustainable and complaint tax. October 2014 contacts modified 2018-06-05 V. Start today and improve your skills.

Credit: pinterest.com

Common tax topics are broken down into plain language that is easy for beginners to understand. Common tax topics are broken down into plain language that is easy for beginners to understand. Illustratives IFRS consolidated financial statements for 2017 year ends Illustrative consolidated financial statements for an existing preparer of IFRS. Part 3 - Representation Practices and Procedures We have divided each part of the exam into 3 units see Figure 1. O Once the IRS sends acknowledgment back to TPG Taxpayers information is electronically sent to lender Metabank o Metabank sends back loan decision to TPG within 24 hours.

Credit: irs.gov

Than 223000 people who are committed to delivering quality in assurance advisory and tax services. Complete Text Material A thoroughly practical always up-to-date text - written especially for home study. ACCTG SVCS TRAINING Reference Training Reference ManualReferenceManual-version 2018-06-04docx Cost Center Accountant Assignments Description Accounts Starting With WBS Accountant Phone Email GENERAL FUND 1XXXX. Ad Learn Tax Preparation online at your own pace. Guide to Tax Preparer Learning Systems LLC Study Material The exam consists of three parts.

Credit: docplayer.net

Guide to Tax Preparer Learning Systems LLC Study Material The exam consists of three parts. The Tax Prep 101 course provides a comprehensive learning package for the foundational concepts of individual tax preparation. October 2014 contacts modified 2018-06-05 V. Go back to the Federal Income Tax Course course description. Illustratives IFRS consolidated financial statements for 2017 year ends Illustrative consolidated financial statements for an existing preparer of IFRS.

Credit: scribd.com

Part 3 - Representation Practices and Procedures We have divided each part of the exam into 3 units see Figure 1. O If Taxpayer is approved for loan and has chosen a check Taxpayer picks up check that day at EROs office. October 2014 contacts modified 2018-06-05 V. These ToTs implemented the manual on the. Following the training a ToT workshop was held in River Gee to hone the skills further of the top beneficiaries.

Credit: scribd.com

As a Tax Refund Firm Tax Preparer compliance documents are vital to complete a thorough. O If Taxpayer is approved for loan and has chosen a check Taxpayer picks. O Once the IRS sends acknowledgment back to TPG Taxpayers information is electronically sent to lender Metabank o Metabank sends back loan decision to TPG within 24 hours. Chuck created these manuals to show you how to compete effectively with local and national tax firms. Tax preparer training manual provides a comprehensive and comprehensive pathway for students to see progress after the end of each module.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tax preparer training manual pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.